The climate debate about Bitcoin mining has sparked a wildfire on the crypto market. The BTC electricity consumption has fallen massively in the last few months.

Profit-taking also dominates day-to-day business in the crypto market at the weekend. Total market capitalization has slipped 2.4 percent to just under $ 1.4 trillion in the past 24 hours. The crypto draft horse Bitcoin is also coming under selling pressure, but is falling comparatively gently with a minus of 1.2 percent. At the time of going to press , the BTC rate was trading at $ 32,912, which means the weekly counter is down 2.5 percent.

Some of the Altcoins suffer more significant losses. Ethereum (ETH) falls four percent to $ 2,120, Binance Coin (BNB), Cardano (ADA) and XRP share a minus of around 3.5 percent. Polkadot (DOT) gets it slightly worse with four percent, while Dogecoin (DOGE) shows the worst performance among the ten largest cryptocurrencies with a discount of around six percent. Likewise in the 7-day trend, where the meme coin slips by 17 percent.

In addition, Uniswap (UNI) just fell out of the ranking of the ten most valuable crypto assets. Thanks to the newcomer Binance USD (BUSD), there are now three stablecoins on the top coin list, which together have a market capitalization of almost 100 billion US dollars.

Bitcoin power consumption is falling rapidly

Hardly any other topic in the crypto space has caused such a sensation in recent weeks as power consumption in Bitcoin mining. With the price fireworks, the hash rate and with it the energy consumption has risen massively in the last few months. So much so that the social debate about the ecological effects of the crypto reserve currency has flared up again. This has not only prompted the Tesla boss to publicly distance himself from the currency. Since then, China has been taking rigorous action against miners and has put the lucrative “Bitcoin mining” on a short leash by imposing a de facto ban. The rest is history: Bitcoin and hash rates have fallen by 50 percent since their all-time high in mid-May.

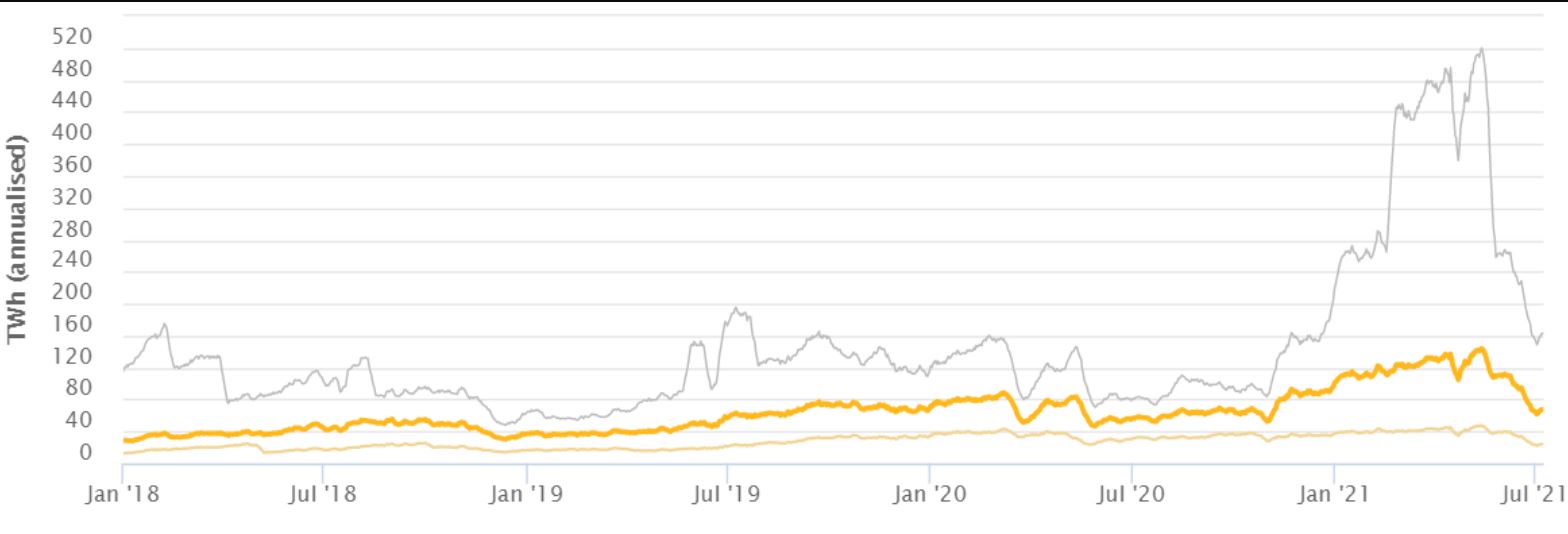

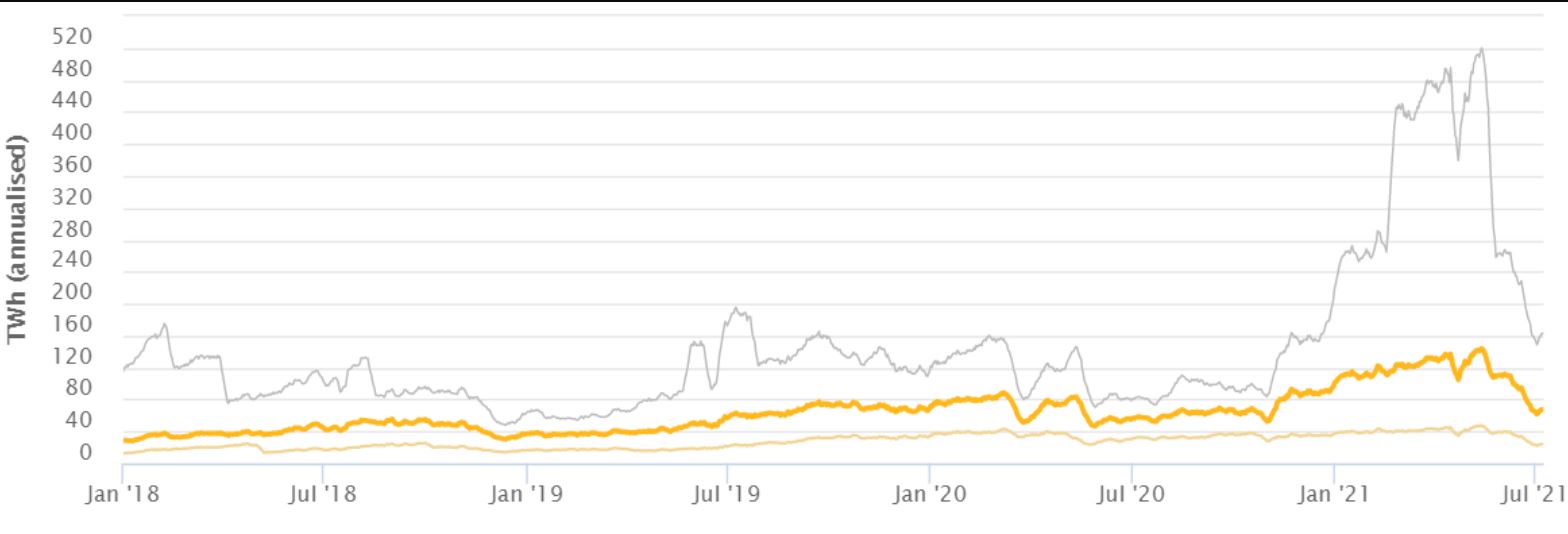

The fact that power consumption has logically decreased significantly with the decrease in the hash rate has so far been ignored in the heated debate about the CO2 footprint. The decline is anything but marginal. As data from the Cambridge Center for Alternative Finance shows, annualized total electricity consumption has fallen by a whopping 52 percent since its all-time high. On May 12th, the estimated annual electricity consumption was still at its peak at 142 TWh. The energy consumption is currently 67 TWh. This is the lowest level since November 2020.

Since electricity consumption is based on rough estimates and there are no statistical surveys of the actual energy mix of mining plants, the Cambridge Bitcoin Electricity Consumption Index also calculates the highest and lowest possible consumption. But even assuming that Bitcoin mining feeds exclusively on dirty coal, consumption has fallen by 68 percent from 514 TWh to 163 TWh. If Bitcoin Mining were to use only renewable energies, consumption would have fallen by 47 percent from 46 TWh to 24 TWh.