“The virtual world will open thousands of new opportunities for this new generation.”

~ Anuj Jasani

Introduction

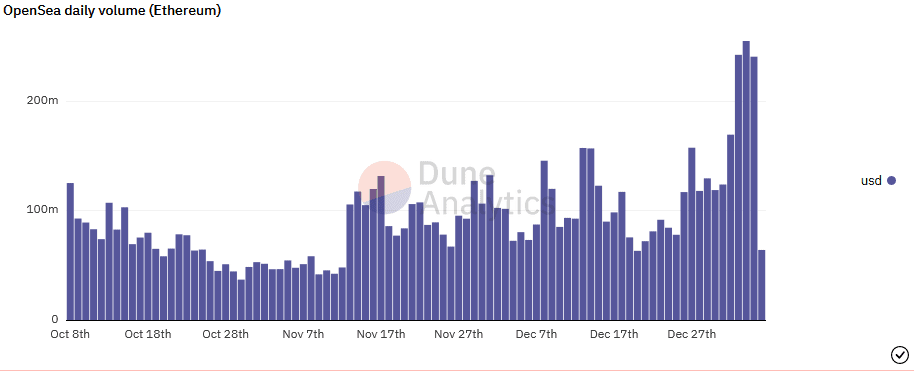

With the metaverse growing rapidly, many people are looking forward to NFTs to take over the virtual world in the anticipated future. As mentioned in a survey conducted by blockchain expert webpage ‘Chainalysis’, cryptocurrencies worth above a whopping $44.2 billion have been spent in 2021 on NFTs alone! So, we believe it’s safe to say that Non-Fungible Tokens are the future!

As more and more persons have become aware of the profits that investing in NFTs open doorways to, NFTs‘ popularity and utilization shall continue to increase in 2022. Presently, numerous NFT initiatives are launching everyday! From globally-famed singers to film stars and public figures, everybody’s making investments in virtual assets and flaunting them on social media, which is leading to an exponential boom in sales. Many artists are setting out their quality works as NFTs to get identified and rewarded. In a similar manner, consumers too have been looking for those initiatives that could offer the most price to their funding portfolio. Let’s break down the best NFT projects to follow this year!

Best NFT Projects to follow in 2022

- Bored Ape Yacht Club

One of the most well-known NFT projects in the present-day world is also one of the coolest ones – the Bored Ape Yacht Club (BAYC)! Some famous names associated with BAYC consist of talk-show host Jimmy Fallon, Future, DJ Khaled YouTuber Logan Paul, Eminem and so many others!

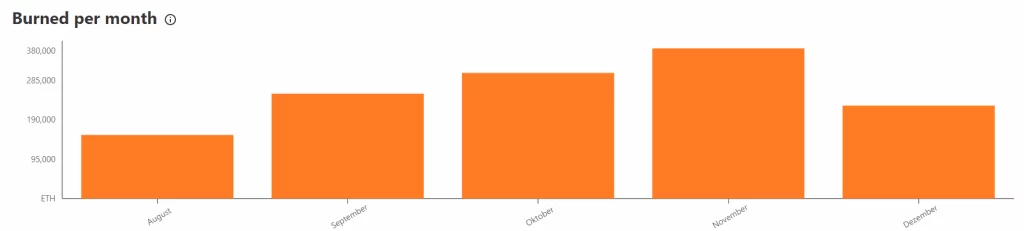

Made by the Yuga Labs, BAYC features lively apes which have various traits and rarities and have been inhibited in the Ethereum (ETH) blockchain. The NFT project has a group of 10,000 different Bored Apes. Launched in April 2021, their costs have skyrocketed in merely a few months, making this series one of the quickest appreciating collectibles within the industry. The maximum price that a BAYC NFT has been auctioned for is 769 ETH or US$3.4 million! Those who own those NFTs are given a Yacht Club club card, which has many perks, such as invites to personal live shows in the virtual world and more.

- Axie Infinity

Axie Infinity is one of the most famous NFT video games within virtual space. It is presently at the pinnacle of traded collection with a top position on Splinterlands, NBA TopShot, and WAX Blockchain closing out with above $0.5 billion in the early weeks of January. Axie Infinity has 3 unique tokens on its game platform. The platform has lately released the Katana Decentralized Exchange (KDEX), which allows gamers to provide liquidity with AXS or SLP to farm RON. Axie Infinity has its virtual nation mapped out with an actual economy! It is certainly one of the top NFT projects to keep an eye on with excessive prospects in 2022 and the years to come.

The Axie gaming theme is quite similar to the Pokemon games. The players have gathered monsters referred to as Axies, which they breed and train for battles. Winners of these PvP battles benefit from rewards. These in-recreation monsters are represented as NFTs. Therefore, these tokens can be traded over diverse secondary marketplaces to gain liquidity.

- Decentraland

Decentraland is an open, NFT based, digital world. Launched in July 2020, it is one of the latest projects amongst NFTs, and is doing surprisingly well! It is certainly anticipated that this Non-Fungible Token project shall take the NFT movement ahead in 2022. We can hope for masses of latest improvements in gameplay, quality of interaction, consumer benefits and fine user experience (UX). When people reflect upon the Metaverse today, they think about Decentraland!

Topping the Ethereum (ETH) blockchain, Decentraland permits the consumer to go into the arena of digital reality wherein they can purchase land, construct houses, create avatars and literally live in virtual reality! Not limited here, owners may even exchange the virtual collectables that they make, at high profits. Likewise, you could explore, create, socialize, exchange, and stay inside it just like the bodily world. Since it is global in scope, one can emerge as a real global citizen. It is one of the most modern video games ever made due to its vast vision and does not restrict participant creativeness in any way! You could make revenue and still have a laugh at the same time.

Conclusion

Non-Fungible Token projects are converting the way we have a look at the world. For the first time in history, we’re witnessing a global motion fashioned through the internet! NFT projects have changed the narrative that the net is just a source of information or knowledge, it has become an investment platform; thanks to NFTs! 2022 guarantees to see increasingly more use cases that impact the actual world.

With the way we’re seeing and expecting technological advancements, it’s potentially simply a matter of time until we come around to appreciate virtual artwork as much as we do, the bodily form of it. The price of a NFT can only be speculated; however similar to any other asset, it too flourishes at the wide variety of people geared up to make investments or indulge.

We have simply broken down a short list of a few of the top NFT projects that you should definitely keep in mind this year, but here’s scope for so much more. Keep discovering, signing off!