Latin America is rehearsing the monetary uprising. El Salvador was the first country in the world to make Bitcoin legal tender. Here we report on the current events.

El Salvador: 30 percent of Salvadorans use Chivo Wallet

The Salvadoran President Nayib Bukele presents “wild” news again on his Twitter account. He wrote that the government’s own Chivo Wallet currently has 2.1 million active users. This means that the wallet could have gained more users in three weeks than any Salvadoran bank manages.

The number is remarkable in that the small Latin American country has a total of just under 6.45 million people. If 2.1 million of them use the Chivo Wallet, that would be almost 30 percent of the population. (Also read: Ethereum becomes more popular than Bitcoin: Analyst says)

The CEO of MicroStrategy, Michael Saylor, finds a possible explanation for this high number of users in a comment on Bukele’s tweet: In his eyes, “Bitcoin is … [the] hope for the people of El Salvador”. However, the events of the past few weeks cast some doubt on this, as one can read from the latest reports.

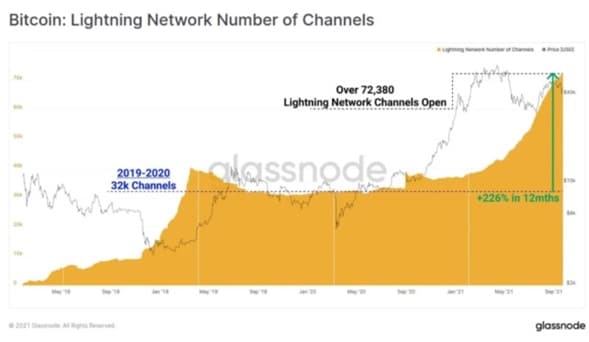

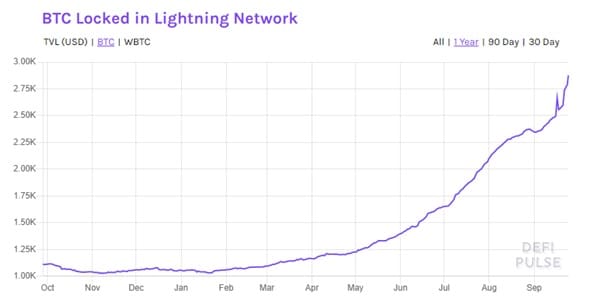

The Chivo Wallet is the wallet that the Salvadoran government makes available to its people to send and receive Bitcoin and US dollars free of charge. It is also intended to enable the change from Bitcoin to US dollars and vice versa without any fees. Allegedly there is also the option of a company version in the on-chain and Lightning-compatible wallet. This allows payments to employees and tax payments.

Bukele buys the dip: El Salvador increases the amount of Bitcoin again

While the Asian markets are causing prices to fall, the Salvadoran President is happy:

He has increased the amount of Bitcoin that the small Latin American country holds by another 150. As he announced on his Twitter account, El Salvador is now in possession of 700 Bitcoin.

This news gets a lot of approval, at least on Twitter: over 25,000 people like the post and in the comments Bukele is congratulated for his purchase.

In response, the 40-year-old went on to write, “They can never beat you if you buy the dip”. Whoever “you” is supposed to be, all domestic and foreign excitement seems to have been forgotten. Instead, the president is sticking to his course of investing in digital coins – no matter what.

El Salvador: creditworthiness falls under Bitcoin lawHiding the domestic problems, Bukele now has to justify itself to foreign concerns about the Bitcoin introduction in El Salvador. The rating agency Standard and Poor (S&P) Global made it clear in its report yesterday that the country’s current creditworthiness could deteriorate. S&P justifies this, among other things, with the fact that Bitcoin would increase the financial risks. On the one hand, this is due to the fact that banks are faced with the challenge of currency discrepancies in lending. On the other hand, the economy would be exposed to considerable financial risks.But it gets worse: S&P sees financial support from the International Monetary Fund (IMF) or the World Bank at risk. Negotiations are currently underway for a $ 1 billion loan for the small Latin American state. Now the IMF spokesman Gerry Rice assesses the situation as “bleak”. The World Bank has already announced in an earlier statement that it cannot support the introduction of bitcoins due to environmental and transparency deficiencies.But perhaps these developments are not so bad in President Bukele’s eyes either – after all, he no longer wanted US dollars.

Burning Bitcoin machines in the capital of El Salvador

People shouted loud slogans in the background of the video by Luis Munos, a Teleprensa journalist. They are upset and concerned about whether the government will be paying out pensions and the like in Bitcoin rather than US dollars in the future. Retirees, veterans and workers in particular have been taking to the streets since it was announced that Bitcoin was legal tender. Their posters have claims like “You [address the president] will pay what people ask you to” or “No to Bitcoin”. According to interviews, many are demonstrating for fear that the volatility of the digital coin is threatening its very existence.

Since yesterday, the dissatisfied have been attacking the city’s Bitcoin machines. A video shows how fire and smoke come out of the destroyed Chivo ATM. Smashed in and sprayed with insulting phrases, it burns on Gerardo-Barrios-Platz in the historic city center. There will soon be 50 of them in the city so that citizens can withdraw their money on the one hand. On the other hand, the machines should provide information about crypto currencies and the connection with the wallet infrastructure.

So far, there seem to be no injuries. But the demonstrators are becoming increasingly aggressive.

No taxes for foreign investors in El Salvador

Whether truth or untruth remains to be seen. Nevertheless, the legal advisor to the President from El Salvador, Javier Arguerta, is already building dream castles for Bitcoin millionaires. In an interview with the AFP news agency, the lawyer said that foreign investors do not have to pay capital gains taxes on Bitcoin profits.

However, this regulation is nowhere recorded in writing. So far, Article 5 of the Bitcoin Act only provides that crypto exchanges do not have to pay any capital gains tax. All other profits, including those that result from securities trading, are subject to a capital gains tax of 10 percent. So far there have not been any changes for foreign investors: inside, companies or actors.

The fact that the President and his legal advisor do not coordinate their statements and accordingly contradict each other has happened several times since the media attention. So it remains to be seen whether there is a planned change in the legal situation or just the need to be at the center of Arguertas’ reason for this statement.

El Salvador: Bitcoin wallet with starting difficulties

On yesterday, September 7th, not only did the Bitcoin law come into force in El Salvador, but the Bitcoin wallet “Chivo” was also published. This should serve as a digital wallet for all Salvadorans who want to jump on the crypto bandwagon. In order to boost Bitcoin acceptance in the country, El Salvador’s President Nayib Bukele has been promoting the Chivo Wallet for some time and, as a special incentive for the installation, also announced that all users will receive a Bitcoin credit at the start of $ 30.

However, the introduction of the wallet is not going completely smoothly. The citizens of the country complained that the app download did not work in the first hours after the law came into force (and the app launch). And even when these difficulties were resolved, the wallet’s servers were so busy that interested parties could not create profiles – and thus did not receive the 30 USD starting credit.

In the meantime, the problems seem to have largely been resolved, but individual users are still complaining about problems with downloading, registering and maintaining their starting credit.

Bitcoin and Ethereum also official means of payment in Panama?

Panama seized the opportunity and announced on the day of the introduction of the Bitcoin law in neighboring El Salvador that the country would like to set the course for the crypto currencies Bitcoin and Ethereum in the direction of acceptance. The Panamanian Congressman Gabriel Silva announced this via Twitter and emphasized that the move had the potential to create thousands of new jobs for the country.

However, Panama El Salvador does not want to emulate completely – there is no mention of a crypto acceptance obligation – at least so far – as the Panamanian television station Telemetro reports .

Bitcoin Pump thanks to El Salvador?

On the occasion of the Bitcoin law coming into force in El Salvador on September 7th, the crypto community has also announced its support for the important step.

In a Reddit thread on the topic, the user u / thadiusb writes that he, too, will invest 30 US dollars in Bitcoin today. 30 US dollars because every Salvadoran who downloads the country’s own crypto wallet “Chivo” today receives this amount – as start-up capital.

The post has met with great support, has already received over 9,100 likes and over 2,000 comments – the vast majority announce their support.

The campaign is to start at 3:00 p.m. Salvadoran time when the Bitcoin Act comes into force.

Bitcoin law goes into effect: El Salvador buys 200 BTC

On the occasion of the Bitcoin law in El Salvador, which comes into force on September 7th, the Salvadoran government is buying 200 Bitcoin. The Salvadoran President – and well-known Bitcoin maximalist – Nayib Bukele announced this via Twitter.

Accordingly, the Latin American nation now holds a total of 400 Bitcoin, which corresponds to almost 21 million US dollars at the current BTC rate of around 52,380 US dollars.

El Salvador wants to punish companies that do not accept Bitcoin

Javier Arguete, legal advisor to Salvadoran President Nayib Bukele, said in an interview on Monday, September 6th, that companies that would not accept payments using the crypto value after the Bitcoin law came into force would face sanctions. This is reported by the country-based newspaper El Mundo .

If the announcement true Arguetes, the threats would be in direct contrast to recent statements by Bukeles that in a Twitter thread wrote that those companies who wanted to continue to focus on cash, which could continue to do so – without fear of sanctions.

El Salvador will introduce Bitcoin law tomorrow

The time has come: In El Salvador, Bitcoin will be legal tender from September 7th.

El Salvador is the first country in the world to make Bitcoin legal tender. The corresponding draft law, which Parliament passed on June 9th, will come into force tomorrow, September 7th. The content of the legal text includes the obligation to accept Bitcoin payments. If the technical conditions prevent BTC custody, the government offers “instant conversion into US dollars”.

Since very few companies are likely to have an adequate technical infrastructure at the beginning, the Salvadoran state could soon be sitting on a veritable digital gold treasure.

No Legal Tender: Disappointment with Bitcoin Law in Paraguay

Bitcoin (BTC) will not become legal tender in Paraguay for the time being. The parliament of the South American country will vote on a crypto law on Wednesday, July 14th. Contrary to previously circulating rumors, this contains no efforts whatsoever to make Bitcoin the national currency. On the contrary: The law provides for strict regulations for the crypto industry in Paraguay. A leaked preliminary version shows that crypto companies such as exchanges and mining farms require registration with the authorities.

Paraguay follows in the footsteps of El Salvador

Will Paraguay become the second country to establish Bitcoin as legal tender after El Salvador? If the two members of parliament Carlitos Rejala and Fernando Silva Facetti have their way, that should be the case. As Rejala announced on Friday, July 9th, on Twitter, a corresponding bill will be introduced into parliament this week.

To date, nothing is known about the content of the law. One can assume, however, that the MPs are based on the Salvadoran model and want to raise Bitcoin to the same legal status as the local currency, Guaraní.

It is also unclear whether the design will fall on fertile ground and receive as broad support as its Salvadoran counterpart.

UN body criticizes Bitcoin advance by El Salvador

The Economic Commission for Latin America and the Caribbean, a UN body for the promotion of economic and social development in Latin America, views the Salvadoran advance with skepticism. General Secretary Alicia Bárcena warned of “systemic risks” regarding Bitcoin adoption in the country.

There is no telling how El Salvador’s economy will react to the introduction of BTC as legal tender. In addition, Bitcoin does not fulfill the basic money functions, among other things, the currency is far too volatile.

El Salvador is giving away Bitcoin to its citizens

Despite criticism from international high finance, Salvadoran President Bukele sticks to his decision: Bitcoin will become the official currency of El Salvador on September 7th this year, when the corresponding law will come into force.

In order to get the population enthusiastic about the project – and incidentally to expand the Bitcoin space by 6 million new users – the Salvadoran government has now announced that it will be giving Bitcoin to everyone in the country. And that’s the equivalent of $ 30. In total, that makes over $ 150 million in Bitcoin.

A transaction that should also be reflected in the prices.