Large investment funds were preparing for the market fall, when it was actively growing, for the next wave of covid-19 even before the spread of the new Delta strain, and dumped the securities of Chinese companies before the Chinese stock market fell.

This is evidenced by their reports for the second quarter.

Reports of US institutional investors appear with a delay: investment funds are required to disclose their positions in stocks over $ 100 million within 45 days after the end of the reporting quarter.

This rule is set to prevent smaller investors from copying the strategies of Wall Street tycoons and thus not affecting the value of stocks.

So now analysts are studying and commenting on transactions that were made by eminent investment funds in April-June.

It turned out that many already then showed an active interest in the shares of companies in “protective” market sectors. They will be the beneficiaries of the next wave of lockdowns when the epidemiological situation worsens.

These purchases were made when the market showed impressive growth, moreover, it is still growing. The S&P 500 rose for the seventh straight month in August and posted its best January-August result since 1997.

The last noticeable correction of shares was observed already in September-October last year – then from the local peak SPY fell by almost 11%.

According to Truist, since 1950, when the index had such an increase, the following year it grew 80% of the time, and the average growth was 10%. However, large investors are not deterred by such data.

For example, investment giant Tiger Global Management, with $ 79 billion in assets under management, and Coatue Management, which manages roughly $ 25 billion, have increased their positions in DoorDash. The company is engaged in the delivery of food products.

Its shares fell below $ 115 in mid-May, and are now trading at $ 193.

In addition, Coatue Management bought additional shares in Moderna, and Lone Pine Capital increased its position in these securities to more than $ 900 million. Lone Pine Capital is an American hedge fund that manages approximately $ 36 billion.

Its president and portfolio manager is Steve Mandel, formerly of Tiger Management. This is why Lone Pine is called one of the 30 “Tiger Cubs” (funds founded by managers who started their careers in Tiger Management).

A number of investment funds have increased their positions in the shares of Zoom and Peloton, as well as securities of other companies providing the opportunity to exercise at home.

True, not everyone adhered to this strategy.

For example, Duquesne Family Office (portfolio – $ 3 billion) Stanley Druckenmiller, a former associate of Soros, increased the share of companies that, on the contrary, would benefit from the economic recovery. (Also Read: Russia is not ready to recognize Bitcoin (BTC) as an official means of payment, price prediction and forecast)

The fund bought shares of Airbnb for $ 86 million (estimated at the end of June), the Marriott hotel chain ($ 35 million), and also increased its stakes in Expedia and Starbucks.

Now let’s see how the funds lived under the control of the legends of the investment business.

Buffett believes there is nothing to buy and invests in a food vendor

Warren Buffett is the CEO, Chairman of the Board and Major Shareholder of Berkshire Hathaway Inc.

Since 1965, Berkshire Hathaway has generated an average annual return of 20%, nearly double the S&P 500 over the same time period.

For the third quarter in a row, Berkshire Hathaway has been selling more than it buys. Since the beginning of the year, cumulative net sales amounted to approximately $ 5 billion, which, however, is not so much compared to the total value of shares in the fund’s portfolio – $ 293 billion.

Investor magazine Barron’s says Buffett simply doesn’t see any attractive companies.

Berkshire spends free money on buying back its own shares from the market: in the second quarter it took $ 6 billion. And the fund has accumulated almost half of the amount invested in shares in the cash: as of June 30, the money in accounts amounted to $ 144.1 billion ( a quarter earlier – $ 145.4 billion).

True, the fund had few significant sales. In the second quarter, Berkshire completely liquidated its $ 180 million position in Biogen, whose Alzheimer’s drug Aduhelm was recently approved by the US regulator.

And positions in the shares of three large biotech companies were reduced: in AbbVie – by 10%, Bristol Myers Squibb – by 15%, in Merck – by 50% (which was the largest fund sale in the reporting period).

But the shares of these companies occupied a negligible share in the fund’s portfolio – in total, by the beginning of the second quarter, they accounted for less than 3%.

Berkshire bought shares of pharmacists mainly in the summer of last year, betting on the demand for the sector in a pandemic, and sold at all-time highs.

Instead, shares of another American pharmaceutical company Organon (specializing in reproductive medicine, contraception, hormone replacement therapy) appeared in the portfolio.

Its share in the portfolio is also very insignificant, and the purchase itself is quite consistent with the strategy of The Wizard of Omaha – to acquire undervalued companies.

Notable sell-offs include a further contraction in General Motors’ stock portfolio, which Buffett began investing in nine years ago.

In the summer, the fund reduced its position in the auto giant’s shares by 10% at once to $ 3.6 billion – now it is the 12th largest position in the portfolio.

Berkshire’s largest purchase in the second quarter was an increase from $ 1.8 billion to $ 2.37 billion in the supermarket chain Kroger. (Must Read: SOL Price Prediction: Solana’s cost exceeded $ 192)

Overall, Buffett’s brainchild has remained faithful to his main investment principle – “buy and hold.”

The top 5 companies (Apple, Bank of America, American Express, Coca-Cola, Kraft Heinz) account for 76.1% of all fund investments in stocks. And this share has remained practically unchanged for a long time.

Dalio prepared for the market fall

In the States, Dalio is called Steve Jobs from the investing world. The hedge fund Bridgewater Associates, which he created, is among the top 10 largest in the world.

He manages about $ 160 billion, and unlike Buffett, he is an advocate of diversification, with 784 positions opened at Bridgewater at the end of June (compared to 47 at Berkshire).

Over the quarter, Dalio’s portfolio has become even more diversified, with the fund’s top 10 assets accounting for 33.04%, up from 38.92% a quarter earlier.

Dalio is one of those who have long warned investors about dangerous signals of a serious market decline. Therefore, his fund is preparing with might and main for a possible correction.

Last quarter, the fund cut its holdings in ETFs similar to the S&P 500 by 37%.

More Analysis: Solana (SOL) Price Prediction: Why it could reach $ 350, thus demonstrating threefold growth

Although his block of shares is still the largest position in the portfolio. Also, the investment in the gold-focused index fund has been reduced by 6%.

On the other hand, investments in the sector of essential goods and health care have grown significantly. The largest purchases were Walmart, Procter & Gamble, Pepsico, Jonhson & Johnson, Danaher, Target and Abbott Lab.

Now the sector of essential goods occupies the largest share in the fund’s portfolio – 26.4%, and health care securities rose to 15.7%.

Similar layouts were recorded in the fund just before the collapse in 2008, Dalio remains one of the main optimists about China among large investors, notes the South China Morning Post.

He calls the current fall of the PRC market temporary. According to the publication, by the end of the quarter, Bridgewater had investments in shares of 37 issuers from the PRC for $ 1.2 billion.

But, by the way, new purchases diluted the share of the fund’s position in the ETF on the index of Chinese securities – from 1.29% to 0.92%.

Thus, the investor reduced the influence of shares of Chinese companies on his portfolio without selling them.

Soros got rid of Chinese papers in time

But George Soros simply got rid of the toxic asset.

Moreover, he did it very well in time. The founder of Soros Funds Management (now Quantum Fund) hedge fund is known as a very aggressive and successful manager. It consistently generates over 30% annual portfolio income.

Soros is making impressive strides with massive short-term bets on currencies and securities, including stocks and bonds.

In the second quarter, George Soros’s company cut positions in many Chinese securities that are traded in the United States. Quantum acquired them in March-April, when the collapse of Bill Hwan’s Archegos Capital triggered a collapse in stock prices from his portfolio.

In particular, the Soros fund sold shares of the media company ViacomCBS for $ 194.3 million, the Chinese IT giant Baidu for $ 77 million and the Chinese e-commerce site Vipshop.

According to Bloomberg, Soros is one of the few large investors who successfully reduced positions in shares of Chinese companies before their collapse in July.

The NASDAQ Golden Dragon China Index (which tracks 98 Chinese companies that trade in the US) fell 22% in mid-summer.

Among the reasons for the fall of securities are the restrictions of Beijing, imposed on the Didi taxi service (traded on the New York Stock Exchange) and the operation of online educational platforms.

However, Soros, like some other investment funds, managed, according to Bloomberg, at least partially “bypassing July, unpleasant for Chinese stocks in the United States.”

At the same time, Quantum was actively increasing its positions in existing securities and acquiring new ones.

For example, the largest shares in the portfolio were increased in securities of Amazon, IT-company Maxim Integrated, pharmaceutical company Elanco Animal and Walt Disney.

The fund increased its position size in put-options on the S&P 500 index by 123% to 2.58% of the total portfolio (7th in terms of share). This deal indicates that Quantum also began to prepare for the upcoming market correction in the second quarter.

Wood continues to invest in technology

Katie Wood is the Founder, CEO and Chief Investment Officer of ARK Invest, an investment management company that builds and actively manages an ETF portfolio.

Founded in 2014, ARK Invest has expanded its assets under management to $ 53.7 billion by early 2021.

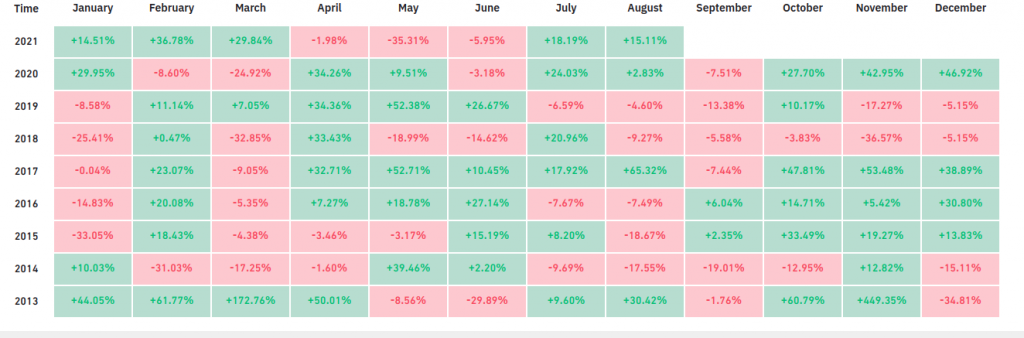

One of the company’s leading ETFs, the ARK Innovation ETF delivered 39% CAGR from 2014 to early 2021. This is more than triple the return on the S&P 500 over the same time period.

And last year, this ETF showed a fantastic 152% return.

Ark Innovation had a dividend yield of 1.75% versus 1.3% in ETFs following the S&P 500.

This year was not so good for Wood: in the second quarter ARK Innovation ETF grew by 9%, but still has not recouped the decline (since the beginning of the year – minus 7%).

Wood is the largest institutional holder of the cryptocurrency and has significantly increased its investments in a number of technology companies in the second quarter.

For example, Splunk Inc. (software and cloud platform solutions) in the fund’s portfolio grew by 4772%, although it still remains insignificant (0.11% of the portfolio).

The share of Reinvent Technology Partners Y, compared to the first quarter of 2021, increased by 2547%.

According to a report at the end of June, ARK Investment Management owned more than 1.1 million shares of the company for $ 11.8 million, representing 0.02% of the portfolio.

The share of the technology company The Trade Desk, Inc increased by 1,073% to 0.31% of the portfolio.

Katie Wood considers genetic engineering to be the most interesting investment.

There are 10 such companies in her portfolio, and they take more than 15% of the invested funds. In second place are electric cars, presented, in addition to Tesla, by the TuSimple project. On the third – communication services (cloud, as well as satellite).

Rounding out the top five are streaming and gaming.

Despite the decline this year and the risks of a Fed rate hike, consensus stubbornly gives high forecasts for almost all securities in Katie Wood’s portfolio. The average target is now about 30%.

Burry Pits Against Wood Pets

Despite rosy analysts’ forecasts, Michael Burry, who predicted the US mortgage bond market crash in the mid-2000s and became the prototype for the short game hero, has put $ 31 million on the reduction of Katy Wood’s flagship fund ARK Innovation ETF.

He also increased his short position on Tesla in the second quarter. Which can be seen as another indirect bet against Wood, and that bet says a lot.

His hedge fund Scion Capital, founded in 2000, gained 55% in its first year amid a 11.88% fall in the S&P 500 index. This became possible thanks to the rates on the fall of overvalued shares of Internet companies.

The following year, the S&P 500 fell 22.1% and Burry’s portfolio rose 16%. But Burry’s real finest hour came during the global financial crisis.

His bet that the American real estate bubble would eventually burst earned him about $ 100 million personally, and his investors more than $ 700 million.

Burry closed his fund in 2009 and returned to the investment business only in 2013, founding the hedge fund Scion Asset Management.

Burry is now betting against Wood and significantly increasing its position in the health care and essential goods sectors.

Buying securities in these sectors is usually used as a hedge in case of anticipated downturns – stocks often rally against a falling market.

The largest purchases of the Scion AM portfolio share in the second quarter were call options (rate on growth) for drug distributors Cardinal Health and McKesson, as well as the world’s largest wholesale and retail chain Walmart.

However, preparing for the worst, Burry is actively making money on the current growth. In the previous quarter, it increased its positions in call options on Facebook and Google – by 71% and 14%, respectively.

In April-June, the securities showed significant growth, so the investor must have made money.