According to the latest figures, the bear market is one of the most violent in history. However, the games and NFT sectors are particularly resilient to this market in the red.

The worst bear market in history?

According to many indicators and figures, this bear market would be the worst in history . In this context, NFT trading is doing more than well. Indeed, it saw its volume increased by 23%. For its part, blockchain gaming attracts many major investors and players continue to flock to take part in this gaming 3.0.

Total market capitalization has dropped 34% since the crash of the Terra ecosystem. Since all projects are experiencing difficult days starting with the leaders Bitcoin and Ethereum. Some of the big companies in the sector like Coinbase or BlockFi have been forced to lay off some of their employees. More seriously, companies like Celsius, Voyager or Three Arrows Capital found themselves close to bankruptcy or outright bankrupt. All of these events heightened investor concern and bearish sentiment for the entire ecosystem.

NFTs do well

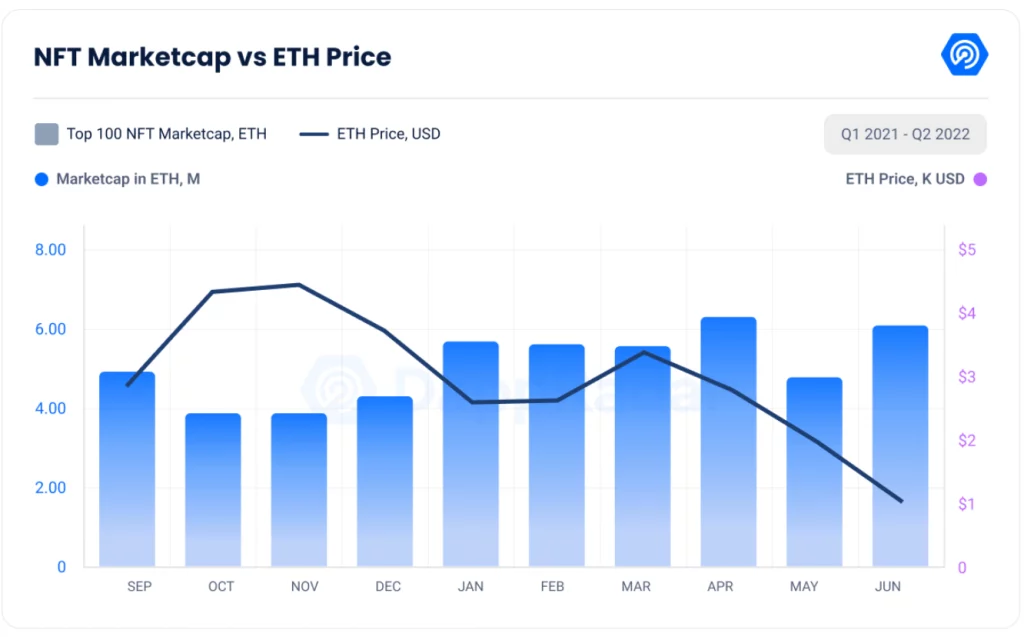

Although the NFT sector has also taken a hit since the Terra crash, it is doing relatively well. Indeed, overall sales have increased by 59% since the second quarter of 2021. Stronger still, trading volumes have increased by 553% year- on-year. If we analyze the trading volume of NFTs in dollars over the last few months, we note a drop of 70% since May. This drop is less spectacular if we take the same figure in Ether: only 55% drop.

The NFT market cap continues to grow despite the bear market. Its low was in October at million ETH and its high was in April at 6 million ETH. In June 2022, it held more than well at 5 million ETH .

A study on the subject mentions:

“Year-over-year, the stats look even more impressive as Ethereum-based collections grew 2093% while Polygon grew 456%, with an overall increase of 1999%.”

The long-term trend is therefore clearly in favor of the various collections and the NFT sector in general. This study also tells us that the leader of NFT marketplaces, OpenSea , is losing market share to its competitors LooksRare or even Magic Eden . The recent phishing attacks on OpenSea have surely played a role in this drop in traffic for the leader of NFT marketplaces. However, despite everything OpenSea remains the leader in this sector but will surely have to expect new attacks from the competition in the months to come!

Blockchain gaming continues to progress

For its part, blockchain gaming is also doing well. According to recent figures, the blockchain gaming industry only fell by 5% compared to 26% for the crypto industry in general. The study tells us:

“This is a bullish indicator for blockchain games, as many have speculated that game dapps will lose most of their player base if they stop being financially profitable for the average user. It turned out that was not the case.”

Spliterlands has become the most played blockchain game . Launched 8 months ago now, it has over 350,000 active daily users with only a slight drop of 4% in recent weeks. Games like Alien Worlds, Farmers World or Axie Infinity follow closely in the top of blockchain games.

Even though Axie Infinity is not the leader, the numbers show that it is the most searched blockchain game in 122 countries. We recently told you about the strong comeback of the pioneer of NFT games.