Elrond (EGLD) seems to make its way up and up, recording a whopping 20.76% upsurge in value from $406 to $485 value. EGLD makes it clear that even if you don’t stand at the top, it does not mean you have only loss ahead of you. Things in the crypto world are very uncertain; nothing ever stays the same for entirely too long.

Elrond perfectly sums up what it stands for, “A highly scalable, fast and secure blockchain platform for distributed apps, enterprise use cases, and the new internet economy.”

Founded back in 2017, the Elrond network aims to provide faster and cost-effective transactions via smart contracts operated by a distributed network of computers. Brothers Beniamin and Lucian Todea developed Elrond to address the issues related to blockchain scalability. They focused on developing a blockchain platform that is better than any other blockchain platform available back then. (Also: Bitcoin to $ 98,000 in November? Trial by fire for stock-to-flow model)

They aimed to develop an interoperable and highly-level scalable blockchain platform, and that is how Elrond Network was conceptualized. As for its capabilities, Elrond Network is a truly powerful network. It can process nearly 10,000 to 15, 000 transactions per second with an average cost of $ 0.001

Elrond Price Prediction 2021 to 2022

Throughout this Elrond stock forecast, we’ll cover both the short and long-term prospects of this platform. However, if you’re in a rush, the bullet points below highlight the main findings of our Elrond prediction 2021 for the months ahead.

- One Month – The current Elrond price is hovering around the $242 level, following a gradual rise since late September. Over the next month, we estimate that Elrond could hit a valuation of $290.

- Three Months – The firm uptrend in Elrond’s price shows no signs of stopping, meaning that the previous all-time highs look likely to be broken. Over the next three months, our analysis projects that Elrond could hit a valuation of $375.

- Start of 2022 – Assuming the Elrond price can finish the year strongly, we’ll likely see the bullish momentum continue into next year. As such, we estimate that Elrond will reach a valuation of $400 by the start of 2022.

Elrond Price Forecast

Now that we’ve explained what Elrond is and its price history, let’s peer into the future and determine this coin’s outlook. As we’ve noted in our other cryptocurrency price predictions, many different factors can affect a coin’s price, so it’s wise to do your own research. With that in mind, let’s look at the technical and fundamental elements of this Elrond forecast.

Technical Analysis

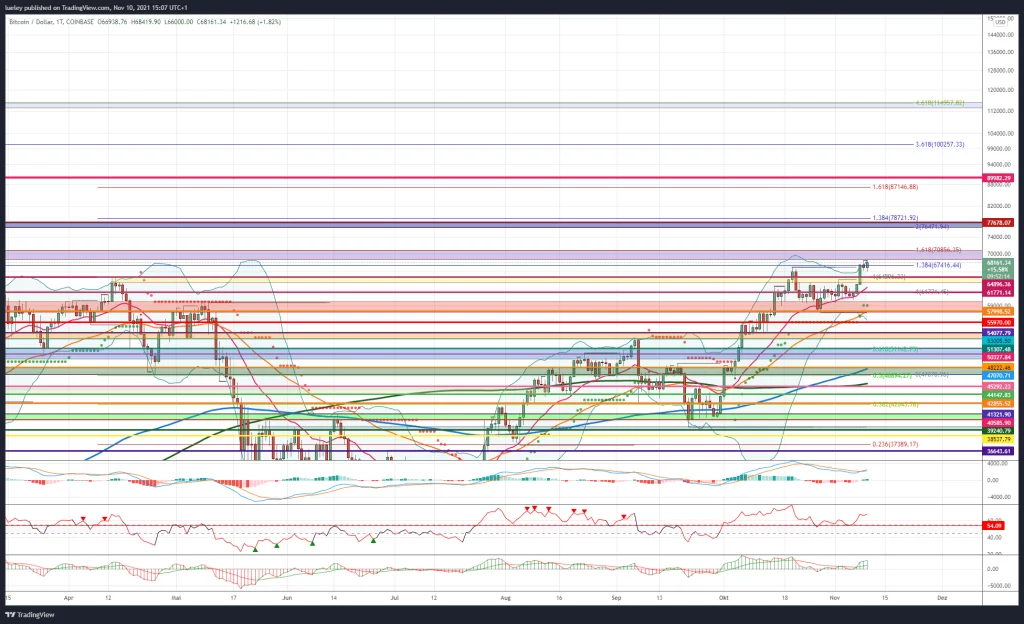

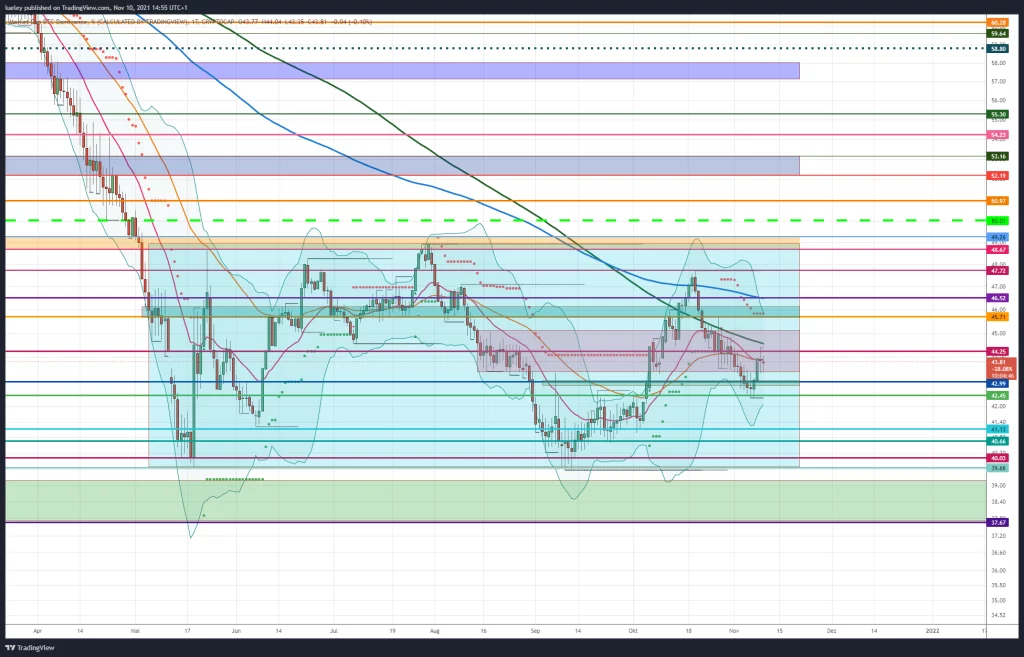

As you can see from the chart, the token price has been climbing steadily since July. Price is printing clear higher-highs and lower-highs, indicating a strong bullish trend. Although there was a significant price change in September after EGLD hit its all-time high, the token has recovered well and seems to be making an attempt once more.

The support level around $198 seems to be relatively strong, as the price has been rejected three times since early September. This is a good sign, as it gives added optimism that Elrond can break past the previous all-time highs. Furthermore, EGLD is trading above the 50-day and 200-day EMAs, which measure the average price over the past 50 and 200 trading days, respectively. Again, this is a signal that the price is showing a bullish trend.

Overall, if you were looking to invest £1000 UK, we’d wait to see how the price reacts around the $300 area. There’s a chance that price could reject and head lower – or we could see a solid close past this level. If the latter occurs, that may represent a good investment opportunity if you’re looking to gain exposure to the EGLD price.

Fundamental Analysis

On the fundamental side of things, EGLD currently has a market cap of $4.7bn, according to CoinMarketCap. This means that Elrond is the 39th largest cryptocurrency globally at the time of writing, with a circulating supply of 19.5m EGLD tokens. The trading volume in the last 24hrs is $83.5m, down 29% from the previous day.

One great thing about Elrond is their Maiar Exchange. This decentralised exchange (DEX) allows users to trade tokens and earn a passive income stream. Furthermore, this exchange is fully integrated with Maiar App, which is powered by Elrond. Therefore, users have complete control over their assets and avoid the centralised nature of large cryptocurrency exchanges.

EGLD: Taking the Expert Analysis

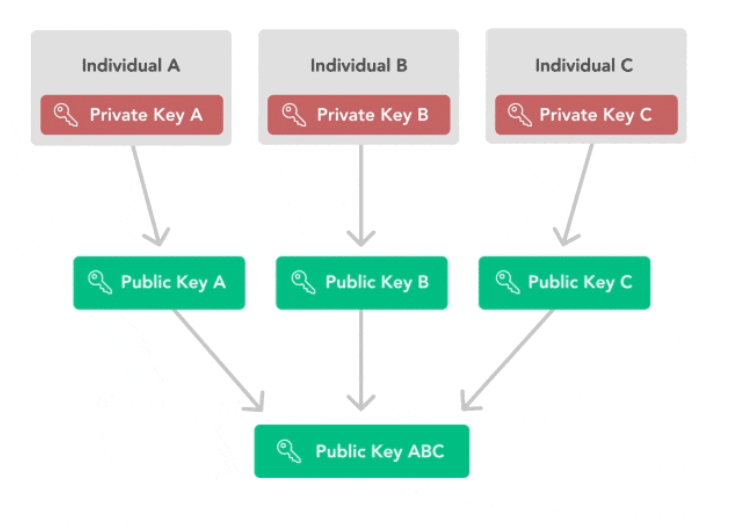

Even though placed in a highly volatile world of cryptocurrencies, favorable factors like tight security protocols and an advanced algorithm play a really pivotal role in influencing investments. The primary objective of the Elrond team has been to ensure transparency and, at the same time, privacy. Finding equilibrium in both could be a tough challenge.

Based on a logical algorithm, Elrond (EGLD) has both short-term rallies and potential long-term advantages. Based on the Elrond price prediction, the coin may reach $250 by the end of 2021.Trading Beasts

According to the future prediction by GOV Capital, the price of the asset is predicted at $437.764 by the end of 2021.GOV Capital

Based on the Elrond price forecast done by Wallet Investor, the coin is expected to reach a price mark of 461.742 by the end of 2021.Wallet Investor

EGLD is an adventurous project to trade and one of the rapidly growing segments. It is more bulls than bears. According to the predictions, it is not hype that it would cross a new all-time high around the $380 mark by 2023.Digital Coin Price

The prediction has a big variation between the minimum and maximum prices, which makes it difficult to decide whether to buy Elrond or not. Therefore it is best to take the minimum prediction as a guideline confirming it as support of $210.21 at best.Crypto Gunther

Elrond (EGLD) might grow threefold from the current price level in six years say by 2026, it should have a clear rally around $250.4 to $310.6, and it will register a new all-time high.Crypto Rating

According to Redditors forecasts, it seems Elrond currency is doomed. It might trade with a flattish price trend and consolidate around $200 by the first quarter of 2022.Reddit Community

Elrond Price Prediction – Conclusion

In summary, this Elrond forecast has examined what the Elrond network is and how it functions. We’ve also explored the outlook for Elrond over the short and long term, ensuring you have all you need to make an investment decision. Overall, we’re pretty bullish on Elrond due to its scalability and low fees. These factors will undoubtedly go in the platform’s favour when attracting dApp developers and DeFi protocols.

Elrond Price Prediction 2021

If all markets turn favorable, the EGLD price is set to break all barriers and perform exuberantly, scaling the peak as aforesaid. Transgressing all limitations over the next year, it would surely show signs of fortune for its investors. According to our Elrond price prediction, backed by robust smart contracts, the Elrond price may easily touch $250 by the end of the year 2021.

Elrond Price Prediction 2022

Considering there are no sudden jolts or a stony path ahead for cryptocurrency markets, Elrond is all set to affirm its strong position as a major attraction among its investor community. The road ahead is full of petals provided the investor’s confidence keeps booming, resulting in a significant push to the EGLD price, taking it to cross all barriers scaling $300.

Elrond Price Prediction 2023

According to our Elrond price prediction experts, these features can help this token gain a much higher price of $340. If the drive for functional crypto continues into 2023, the EGLD price may even see a paradigm rush.

Elrond Price Prediction 2024

There are quite a few speculations going forward for Elrond. Especially keeping in perspective the technological announcements and progress the corporate has designs on, there are assumptions by our Elrond price prediction experts its price may reach $400. The favor is done by majorly security and scalability features. The exciting promotional ventures may do the rest making the investors harvest the gains and make it a profitable investment.

Elrond Price Prediction 2025

Elrond is also active in community initiatives. Considering they keep up the momentum, garnering a significant market cap, their initiatives focusing on education, outreach, and innovations may take them to an appreciable level of $460. If you want to know other coin forecasts, then check our post on price prediction for Cryptocurrency.

![Best VPN to Watch Netflix VPN for Netflix [Updated Nov 2021]](https://citytelegraph.com/wp-content/uploads/2021/11/Best-VPN-to-Watch-Netflix-VPN-for-Netflix-Updated-Nov-2021.jpg)