Litecoin (CRYPTO: LTC), the cryptocurrency that was designed to provide fast, secure and low-cost payments via the blockchain has turned 10 years old.

The Coin: LTC was released on October 7, 2011, and the network went live five days later on October 13, 2011. (Also Read: Solana (SOL) Price Prediction: Why 500 dollars by 2022?)

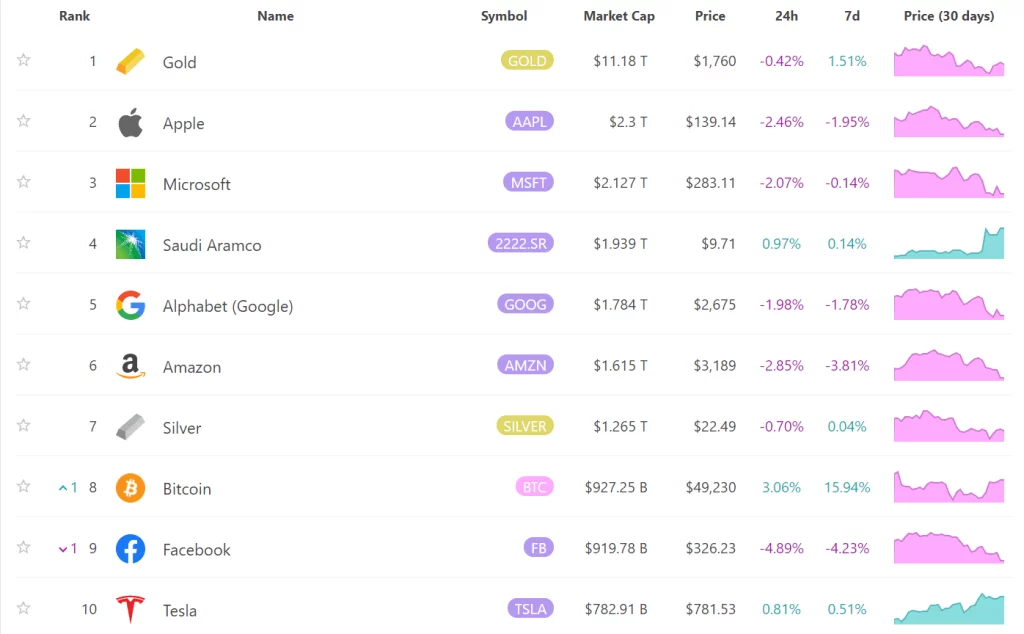

Today, it is the 15th largest coin by market cap and gets 0.54% in terms of market dominance, according to data from CoinMarketCap.

LTC has a market capitalization of approximately $ 12.35 billion and an outstanding supply of 68.7 million tokens.

The Early Days: LTC, which is an early fork of Bitcoin (CRYPTO: BTC), was founded by Charlie Lee, a former employee of Alphabet Inc’s Google subsidiary (NASDAQ: GOOGL) (NASDAQ: GOOG).

Lee discussed the early days of LTC in a Twitter thread on Thursday. The founder of LTC said that a number of early altcoins did not survive, such as Namecoin, Ixcoin, Locoin, Solidcoin, etc.

See also: Dogecoin Co-Creator, Others Respond to Litecoin-Walmart Fiasco: Why You Shouldn’t Take ‘These Things So Seriously’

“I basically took everything good from those altcoins (speed, CPU mining) and had a fair launch. And that’s why Litecoin has succeeded where others have failed, ”Lee wrote.

“The name Litecoin came to me quite quickly. I first thought of something like an Elitecoin. Then Litecoin jumped out.

So I had to reverse engineer and I managed to create the genesis block on

What a lot of people didn’t know was that I put the title of Steve Job’s death in the Genesis hash. This proves that the genesis block was created after 05/10/11. pic.twitter.com/Zn7tnRBgUM

– Charlie Lee (@SatoshiLite) October 7, 2021

Lee couldn’t help but take a look at Ethereum co-founder Vitalik Buterin, who had criticized the choice of Litecoin’s name.

I forgot to mention that I chose Litecoin because Litecoin is the Lite version of Bitcoin. It’s faster, cheaper and easier to use.

And we got to see a young & unknown (at the time) @VitalikButerin hating the name. I prefer Litecoin to Etherium. Wait, is this Ethereum? pic.twitter.com/kCLUUNbiel

– Charlie Lee (@SatoshiLite) October 7, 2021

The Investment: LTC hit a record high of $ 412.96 in May and is trading 56.46% below those levels. At time of going to press, on a 24-hour basis, LTC has traded 2.82% higher at $ 180.18.

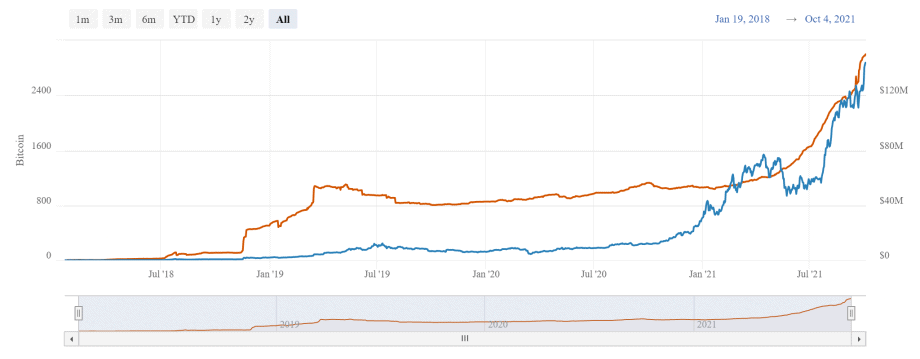

Since the start of 2021, LTC has gained 43.29%. In comparison, BTC rose 84.58% over the same period.

The first available CoinMarketCap data shows that LTC was trading at $ 4.35 on April 28, 2013. If an investor had held onto their investment since then, they would have gained 4042.06% so far.

This means that $ 1,000 invested at the time would have bought 229.88 LTC, which would be worth $ 41,420.69 today.

Litecoin Prediction and Forecast: LTC Over $165 Now!!

Litecoin Prediction and Forecast: For the next 24 hours Price of Litecoin is predicted to be in range of $ 151 and $ 172.

Litecoin Price Prediction Daily: Current Prices

The current price of Litecoin is $ 167.13 which is 0.32% higher than 24 hours ago.

Litecoin Prediction Daily: Future Prediction

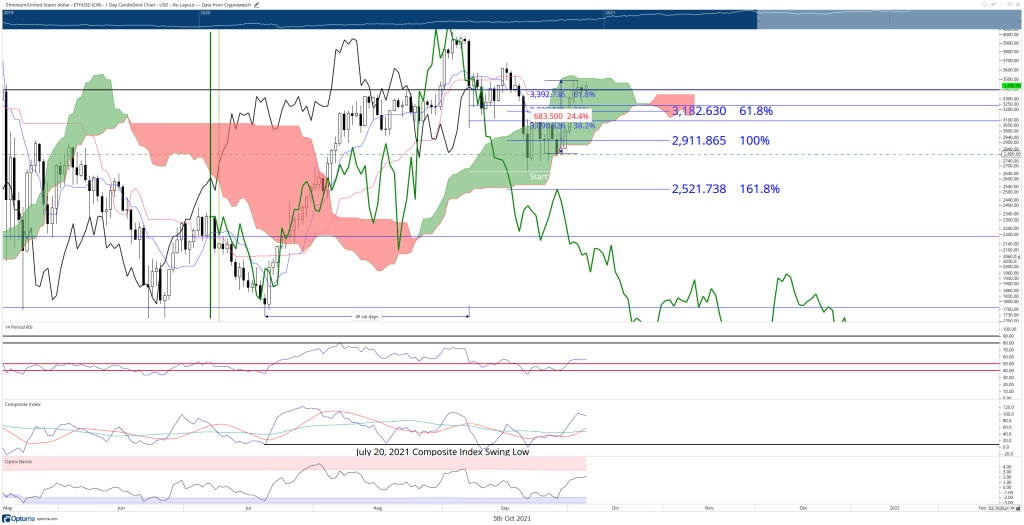

In July 2021, the price of Litecoin hit an extreme low as it was trading around $105. Two months since then, Litecoin hit its highest, since May, and was recently trading close to $230. At this point, it is clear that the rise of Bitcoin is helping the rise of Litecoin too. Alternatively in the last few months, the Litecoin network’s fundamentals have also improved which means that there has been a rise in the number of transactions per second, a rise in the number of addresses and active addresses.

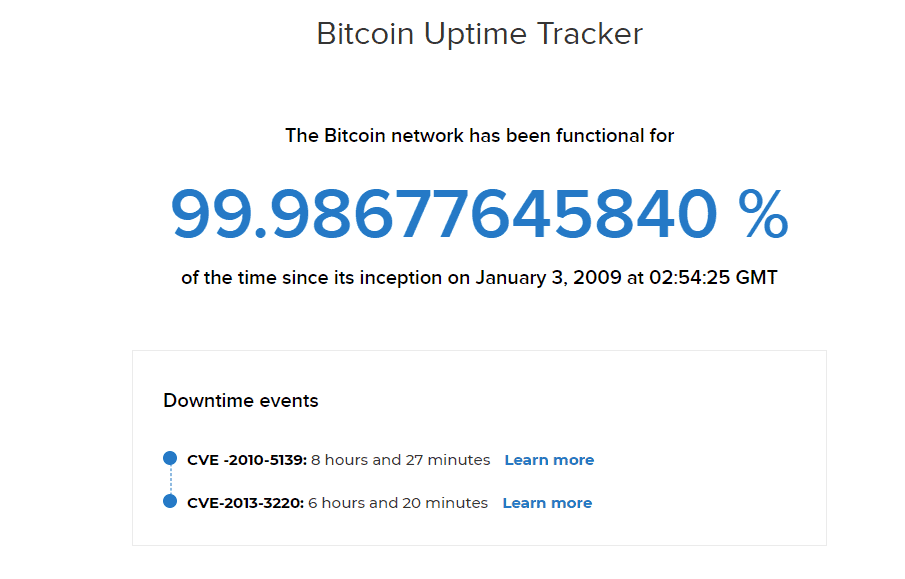

It must be noted that Litecoin (LTC) is one of the very first projects to copy and modify Bitcoin’s code and use it to launch a new cryptocurrency. Now with countries like El Salvador, Cuba stepping in to accept the cryptocurrency, the crypto market has witnessed a rapid rise. Moreover, the announcement of Facebook to include crypto in its payment wallet has heavily boosted the crypto market. Litecoin is one of the latest to add NFT capabilities to its platform.

However, in the last 24 hours, Litecoin saw a crash of over 15% with its price falling to below $163. But the buyers came in and aided the rise of Litecoin once again signaling strong support for the coin. Currently, Litecoin is trading above $180. Therefore, the chances of Litecoin rising once increased.

Litecoin Price Prediction and Forecast: What is Litecoin?

Litecoin (LTC) is just another drop in the wide ocean of Cryptocurrencies. Why are we talking about LTC? because it is coming up as one of the major Cryptos in today’s market. Litecoin is an open-source software that was introduced un the license of MIT/X11. Litecoin can be termed as a peer-to-peer cryptocurrency. Litecoin was introduced in October 2011 as an altcoin, however, in technical terms, LTC is almost similar to Bitcoin.

Charlie Lee is the founder of Litecoin. Lee, back in 2010, wanted to hand the investors an upgraded version of Bitcoin. Something the investors can find handy to rely on or an affordable version of Bitcoin. The term Litecoin (light+coin) is inspired by the name Bitcoin. Litecoin is said to be an ameliorated version of Bitcoin. The added features in Litecoin have certainly made it more reliable than Bitcoin.

After 10 years of its formation, Litecoin, now, ranks amongst the top 10 cryptocurrencies in the world. As per reports, Litecoin has found its place in the center of all crypto transactions. LTC has inspired a better mode of payment since the time of its inception. The most noticeable features of Litecoin have come up as a huge advantage for investors. The features include proficiency in terms of speed and reduction in transaction fees.

Litecoin Price Prediction and Forecast: Price Prediction 2021-2022

Litecoin price was listed at $124.09 at the start of 2021. As of now, Litecoin is being traded at $215.95. LTC has witnessed a rise of 74% from the beginning of 2021 till now. As per the forecast, Litecoin will be priced at $252 at the end of 2021, which will see a growth of +103% in one year. A total rise of 17% is being predicted from this date to the end of the year. Moving into 2022, Litecoin is expected to reach $267 by the first half. However, a drop of $12 is expected in the start of the second half and the market is expected to be around $255 by the end of 2022.

Litecoin Prediction and Forecast: Is Walmart accepting Litecoin?

Litecoin saw a massive rise in price on 13th September after news of the Litecoin and Walmart tie-up circulated and within 30 minutes the price was up 25%. The coin was trading at $232 however, the rise was short-lived.

The news of the Litecoin-Walmart tie-up turned out to be fake. Walmart said a press release announcing a Litecoin partnership is fake. Charlie Lee, the creator of Litecoin, said an employee mistakenly tweeted about the announcement after seeing the fake release.

After the clarification, Litecoin crashed exposing the vulnerable side of the cryptocurrency. Currently, the coin is hovering around $178.