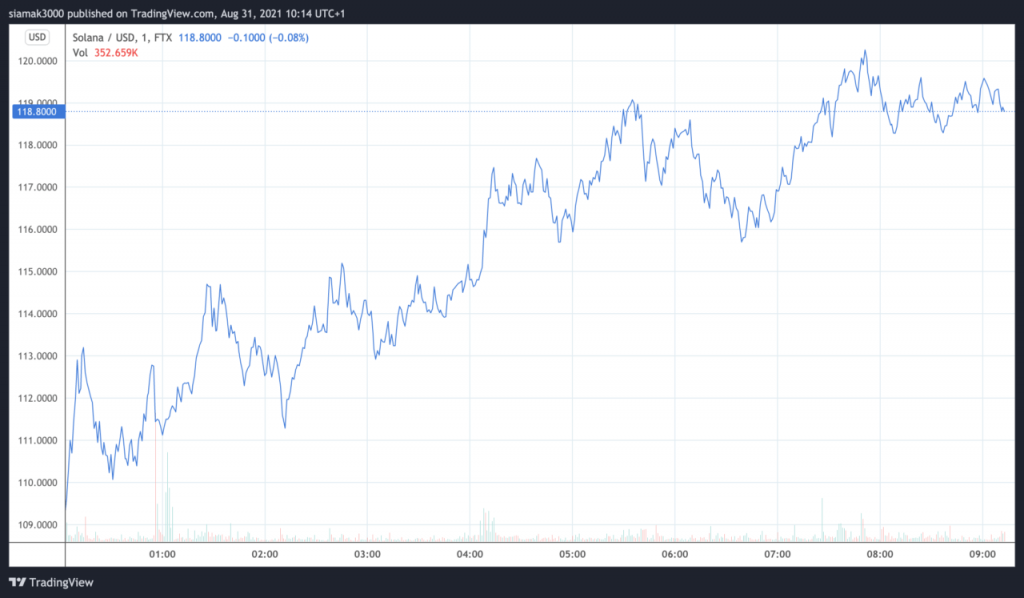

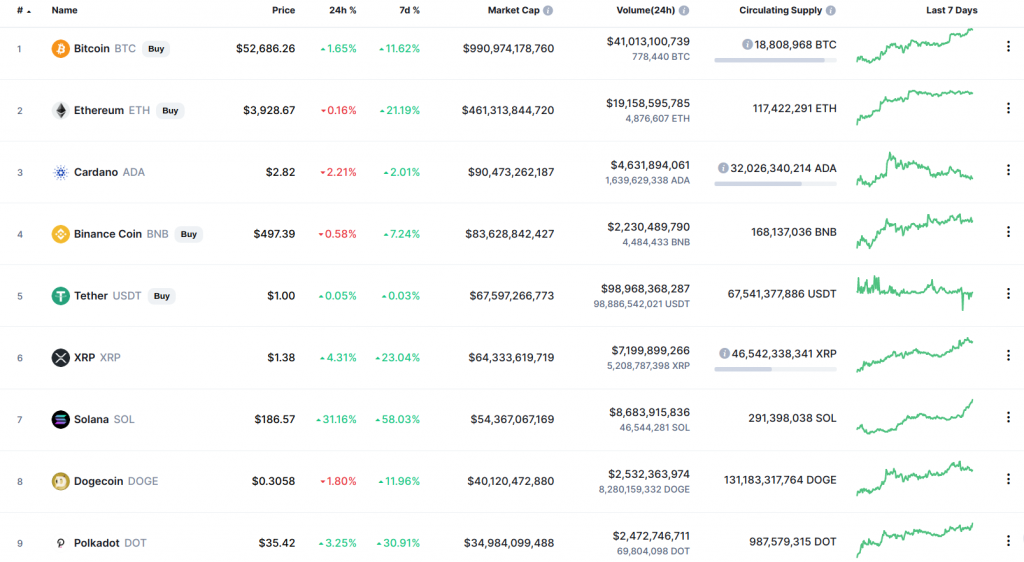

Solana (SOL), one of the most successful projects of the last month, never ceases to amaze. The currency’s capitalization has passed the $ 55 billion mark, so this cryptoasset has every chance of moving Ripple (XRP) from sixth place in the CoinMarketCap croak soon. (Also Read: Salvador bought 400 Bitcoin (BTC) and is ready to legalize cryptocurrency)

After SOL pushed Dogecoin (DOGE) from the seventh row of the CoinMarketCap rating and stopped climbing around $ 140, many thought that the altcoin rally, suddenly appearing in the TOP 10 for cryptocurrencies, was going to s ‘Stop. However, Solana found a way to respond to the pessimistic mood of some negotiators and once again captured the minds of the entire crypto community.

At the time of writing this article, Solana is trading at a price range above $ 190 and it doesn’t look like this asset is going to stop. The project’s market cap has exceeded $ 55 billion and to move Ripple out of its place SOL only needs to cross the $ 230 mark.

Recall that Solana has already overtaken Polkadot, Chainlink, Dogecoin and Uniswap in market capitalization. The asset is still far from emulation with Ethereum, however, this no longer seems to be something unattainable.

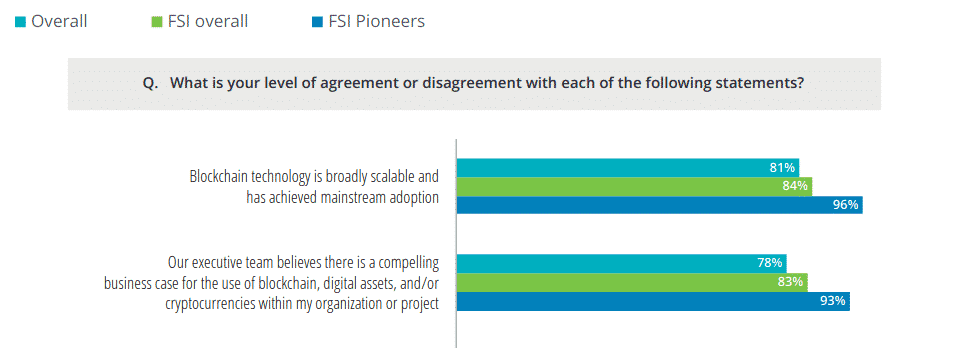

The Solana protocol is designed to facilitate the creation of decentralized applications (DApps). It is geared towards improving scalability by introducing Proof of History (PoH) consensus in combination with blockchain consumer Proof of Stake (PoS) consensus.

Thanks to its innovative hybrid consensus model, Solana appeals to small traders as well as institutional investors. The main objective of the Solana Foundation is to make decentralized finance available on a large scale.

SOL’s current price spike is believed to be related to a recent announcement by FTX CEO Sam Bankman-Fried regarding the introduction of an NFT exchange platform that allows for an act of buying / selling. sale of non-fungible tokens between the Solana and Ethereum blockchains.

Solana (SOL) Price Prediction/Forecast for 2021, 2022, 2023, 2024, 2025 and 2030

At Citytelegraph we predict future Solana price predictions/SOL forecast by applying deep artificial intelligence-assisted technical Analysis on the past price data of Solana. We do our best to collect maximum historical data for the SOL coin which include multiple parameters like past price, Solana marketcap, Solana volume and few more. If you are looking to invest in digital cryptocurrencies and want good return on your investments, make sure to read our predictions.

Solana Price Prediction 2021

According to our deep technical analysis on past price data of SOL, In 2021 the price of Solana is predicted to reach at a minimum level of $119.75. The SOL price can reach a maximum level of $132.31 with the average trading price of $124.21.

Solana Price Prediction 2022

The price of Solana is predicted to reach at a minimum level of $180.84 in 2022. The Solana price can reach a maximum level of $210.24 with the average price of $185.81 throughout 2022.

Solana Price Prediction 2025

Solana price is forecast to reach a lowest possible level of $555.02 in 2025. As per our findings, the SOL price could reach a maximum possible level of $673.84 with the average forecast price of $575.41.

Solana Price Prediction 2026

According to our deep technical analysis on past price data of SOL, In 2026 the price of Solana is forecasted to be at around a minimum value of $854.62. The Solana price value can reach a maximum of $985.10 with the average trading value of $877.64 in USD.

Solana (SOL) Price Prediction 2027

The price of Solana is predicted to reach at a minimum value of $1,252.52 in 2027. The Solana price could reach a maximum value of $1,509.09 with the average trading price of $1,287.62 throughout 2027.

Solana Price Prediction/Forecast 2028

As per the forecast and technical analysis, In 2028 the price of Solana is expected to reach at a minimum price value of $1,806.58. The SOL price can reach a maximum price value of $2,166.13 with the average value of $1,870.96.

Solana (SOL) Price Prediction 2029

The price of Solana is predicted to reach at a minimum value of $2,696.51 in 2029. The Solana price could reach a maximum value of $3,124.99 with the average trading price of $2,771.35 throughout 2029.

Solana Price Prediction 2030

Solana price is forecast to reach a lowest possible level of $3,772.15 in 2030. As per our findings, the SOL price could reach a maximum possible level of $4,586.83 with the average forecast price of $3,910.72.