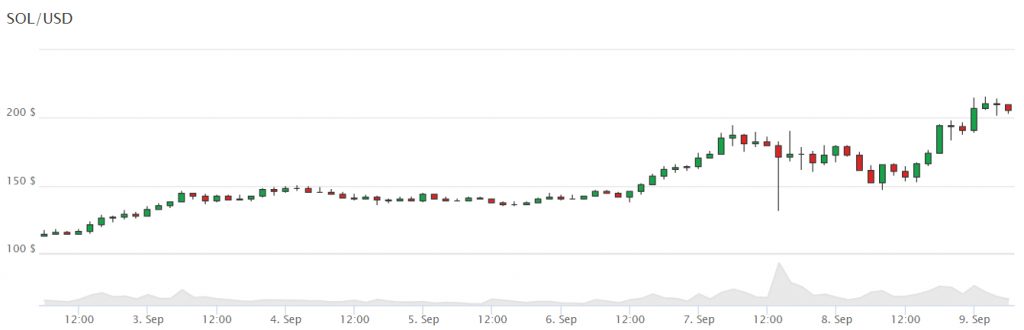

After El Salvador’s decision to legally recognize two currencies in its territory, namely the dollar and the Bitcoin, we are witnessing the emergence of new monetary dynamics. In the coming years, El Salvador will be closely watched by economists as this country remains the first to test Bitcoin. The economy of El Salvador remains a rather unstable, inegalitarian and undiversified economy. In this, El Salvador has a certain comparative advantage in adopting several national currencies compared to developed countries. Nevertheless, the instability of Bitcoin remains a strong monetary constraint. Here we will try to assess the advantages or disadvantages of adopting Bitcoin as a national currency.

Focus on the economy of El Salvador.

Growth and inflation.

El Salvador remains a fairly unstable economy. With a GDP of $ 27 billion in 2019, El Salvador is the 103rd economy in the world. In addition, average annual inflation measured since 1966 is + 4.36% while average growth stands at + 0.67%, which is relatively low. The country has accumulated a strong stunted growth mainly due to its political situation at the end of the 20th century. In addition, over the last decade, there has been an extremely sharp decrease in inflation. For its part, public debt rose from 27% of GDP in 2000 to nearly 60% in 2017.

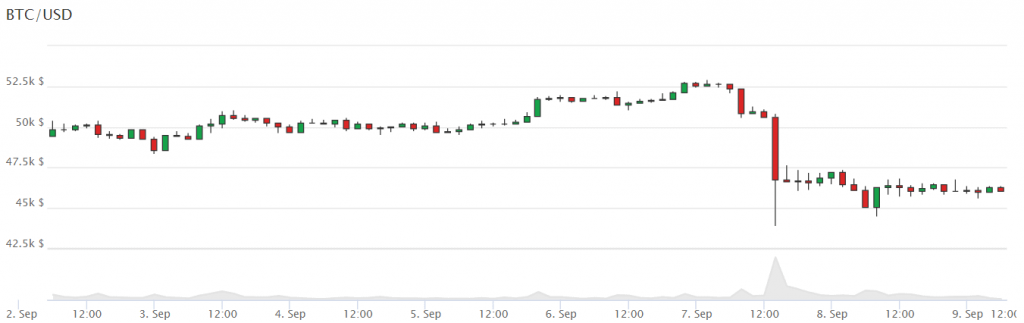

Buying the dip 😉

— Nayib Bukele 🇸🇻 (@nayibbukele) September 7, 2021

150 new coins added.#BitcoinDay #BTC🇸🇻

Nevertheless, according to the United States Census Bureau, nearly 2.2 million Salvadorans would live in the United States in 2019. That is to say, nearly a third of the population of El Salvador would immigrate to the United States. United . At the political level, the President is elected for 5 years while the 83 deputies of the assembly are elected for 3 years. The recent adoption of Bitcoin has propelled to the forefront of the global stage

The question of currency.

The national currency of El Salvador has been the US dollar since 2001. The US dollar notably replaced the Salvadoran colon, the country’s national currency between 1892 and 2001. The adoption of the dollar as the national currency has changed many monetary perspectives in the country.

Using the dollar as a national currency has two major consequences for an economy like that of El Salvador:

- First, the use of the dollar allows El Salvador to retain its purchasing power to continue imports from the United States. The absence of a risk of collapse of the national currency allows the country to benefit from the stability of the American economy and an attractiveness for the export of its products.

- Second, the use of the dollar as a national currency can pose serious limitations. El Salvador is first of all very dependent on the economic development of the United States. Then, the use of the dollar poses a problem of overvaluation of the currency. Indeed, the difference in economic performance between the United States and El Salvador causes an overvaluation of the dollar compared to the Salvadorian economy. This results in deflationary pressure on prices, which we have seen since the adoption of the dollar as the national currency.

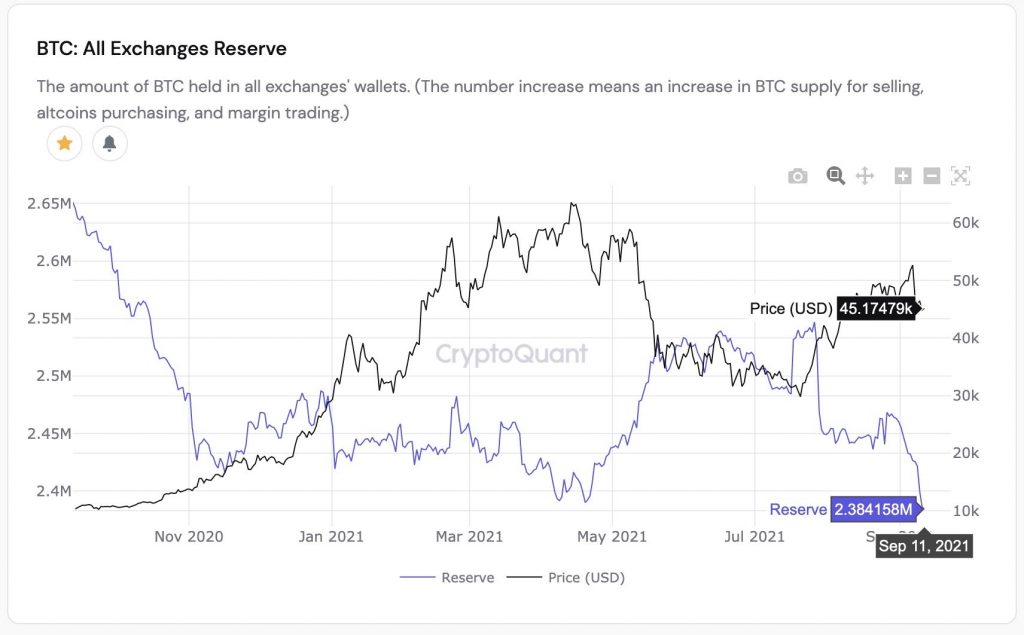

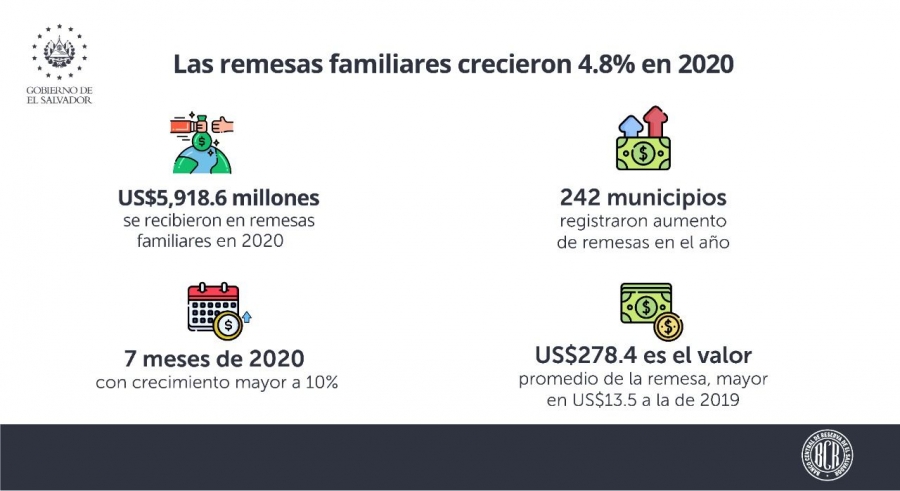

In addition, the fact that the equivalent of a third of the population of El Salvador resides in the United States implies the presence of significant remittances. According to the Central Reserve Bank of El Salvador , the total amount of transactions that have arrived in El Salvador (caregivers of immigrants to the United States) amounts to almost $ 6 billion, which is very significant. In fact, we can deduce that aid from the United States represents the equivalent of 22% of El Salvador’s GDP. It is obvious that the question of currency has a lot to do with it.

The question of international trade.

After a large deficit in the balance of payments after the 2008 crisis, El Salvador is now seeing its situation improving. El Salvador’s balance of inward and outward capital flows rose to +130 million dollars (surplus of 0.5% of GDP).

On the other hand, the trade balance, that is to say the difference between exports and imports, is structurally in deficit. The country mainly exports clothing and agricultural products, including coffee. But at the same time, the country imports a lot of consumer products and raw materials. In 2020, the trade balance was in deficit of 18.4% of GDP, or nearly $ 5 billion. The role of aid via Salvadoran emigrants in the United States thus remains a highly strategic economic stake for the country. Indeed, American aid makes it possible to close the trade deficit, thus generating a globally stable balance of payments, even in surplus.

ESTIMATE THE GAINS AND RISKS FOR EL SALVADOR.

Adoption of Bitcoin.

Nayib Bukele in particular specified that the objective of such a decision is “to allow financial inclusion to thousands of people who are outside the legal economy” . Indeed, according to data collected by the President, nearly ” 70% of the population does not have a bank account and works in the informal economy”. However, major opposition groups remain within the population, mainly fearing the high volatility of Bitcoin.

To be able to launch Bitcoin as a national currency, the President has planned to deploy a set of “chivo” distributors, in order to be able to exchange his bitcoins for dollars anywhere in the country. Chivo is the portfolio of El Salvador. Thus, on September 7, 2021, the President of El Salvador declared that the state held 550 Bitcoins, the equivalent of nearly 24 million euros just before the flash crash that followed.

Estimate the advantages and disadvantages.

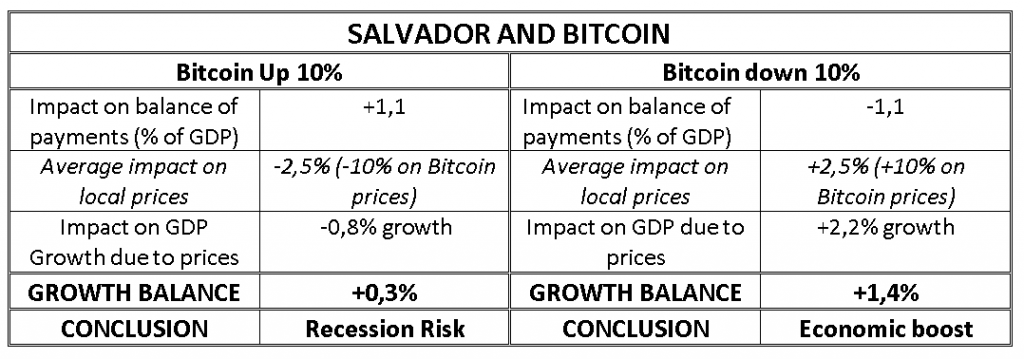

An increase in remittances by Salvadorans in the United States would thus cause substantial gains, in particular in the event of a rise in Bitcoin. An average increase of 10% of Bitcoins held by resident Salvadorans could thus bring the country up to 1.1 point of GDP per year, considering that 50% of aid is paid in Bitcoins and kept for at least one year. Conversely, a drop of 10% would impact the national income in the same proportion. In addition, we do not count here the positive or negative impact of Bitcoin variations on internal payments.

Also Read:

- The shipping giant Amazon wants to make the delivery process more secure with Password

- Bitcoin (BTC) Price Forecast: Week ends in the red

- Cardano Price Prediction, ADA Forecast: Nothing will stop Cardano’s uptrend

However, major drawbacks remain. As explained in our previous publications, Bitcoin concentrates an extreme volatility of its variations.

We consider the following parameters here, with a very strong diffusion of Bitcoin in the economy: 50% of transfers from the United States are made in Bitcoins, 25% of payments in the territory are made in Bitcoins. In addition, we calculate from the Inflation-GDP correlation for El Salvador the probable impact of the price variation on the GDP (correlation of + 60% over 15 and 20 years).

This model obviously does not correspond to a possible reality, but does inform us well about the nature of the risk and the possible gains of a strong adoption of Bitcoin in El Salvador. The balance of additional or lower growth generated by variations in Bitcoin allows us to succeed in our reasoning. Paradoxically, we observe that a Bitcoin following a too rapid rise would limit economic growth in El Salvador. Conversely, a measured decline Bitcoin would promote economic flexibility, but the risk of a stagflation crisis would become very significant if the fall in Bitcoin became large.

Conclusion

In short, the choice of El Salvador to adopt Bitcoin as its national currency is not an unreasonable choice, but a strategic one. El Salvador can thus succeed in boosting an essential element of its balance of payments (aid from the United States). In addition, the adoption of cryptocurrency would increase the overall speed of trade in the country. Nevertheless, a scenario modeled from a strong democratization of Bitcoin in the country shows the need for a certain stability of the currency. Indeed, strong annual variations in Bitcoin would lead, in the event of strong democratization, to crises of stagflation or repeated depression. However, structurally coupled to the dollar, Bitcoin can therefore remain a positive calculation for the country.